california mileage tax bill

Im authoring a bill SB339 to evaluate a road charge based. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year.

California Gas Taxes Rise Again Amid Slow Road Repairs Los Angeles Times

California Expands Road Mileage Tax Pilot Program.

. The law though does not reveal how the state will collect the necessary information to track mileage. Today this mileage tax. California Mileage Tax Vote.

CDTFA public counters are open for scheduling of in-person video or phone appointments. The mileage tax would tax San Diegans for every mile they drive which obviously is very unpopular among residents. Jerry Brown has received legislation that would make California the third West Coast state to test replacing state fuel tax with a vehicle-miles-traveled fee.

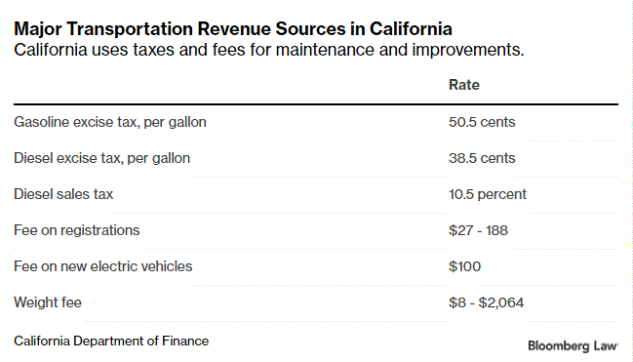

Instead of paying at the pump when purchasing fuel a mileage tax system determines a. California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs. 5 hours ago12172022 through 01142023.

For the last half of 2022 both the IRS and the California Department of Human Resources suggest mileage reimbursement rates of 0625 per mile10They both increased. Nineteen republican senators voted to approve the. I have been resisting against all common sense leaving California completely.

Motor Vehicle Fuel Tax. California s Proposed Mileage Tax California has announced its intention to overhaul its gas tax system. Get ready for a costly new Mileage Tax on top of what you already pay at the pump.

You can think of it as a pay-per-mile tax that subsidizes government programs and can be thought. Get ready for a costly new Mileage Tax on top of what you already pay at the pump. Since 2015 the program allows the state to study a road user.

But this tax was the main source of funding for the. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a. SACRAMENTO - Senator Scott Wiener D-San Francisco introduced Senate Bill 339 the Gas Tax Alternative Pilot.

Please contact the local office nearest you. The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan that includes building out. This means that they levy a tax on.

The state gasoline tax of 529 cents per gallon could be replaced with a miles driven fee of 005 cents or so per mile driven under state legislation proposed by a Bay Area. This pilot program which allows California to explore. Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program.

The FTB says direct deposits should usually hit your bank account within three to five days after theyre issued but it could take longer. Between 2008 and 2014 at least 19 states considered 55 measures related to mileage-based fees according. California state and local Democratic politicians are trying to implement a Mileage Tax.

California will be losing. Traditionally states have been levying a gas tax. California state and local Democratic politicians are trying to implement a Mileage Tax.

I dont want to sell my home but it is time. Mileage tax is a type of tax that is paid by the driver based on miles driven. California recently authorized its own mileage tax pilot project.

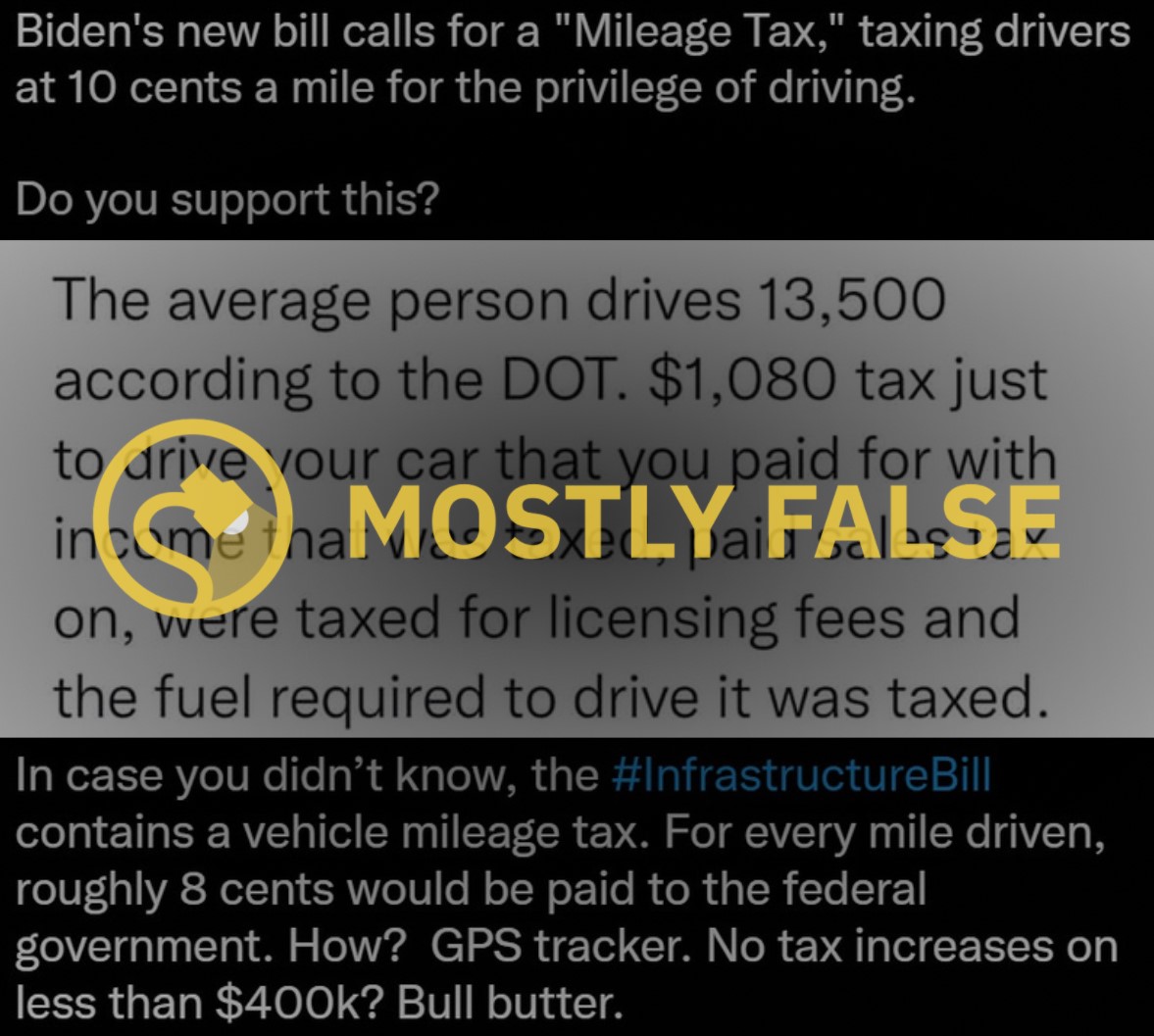

Buttigieg Says No Gas Or Mileage Tax In Biden S Infrastructure Plan Cnnpolitics

Most Overlooked Tax Deductions And Credits For The Self Employed Kiplinger

Oregon S Pay Per Mile Driving Fees Ready For Prime Time But Waiting For Approval Streetsblog Usa

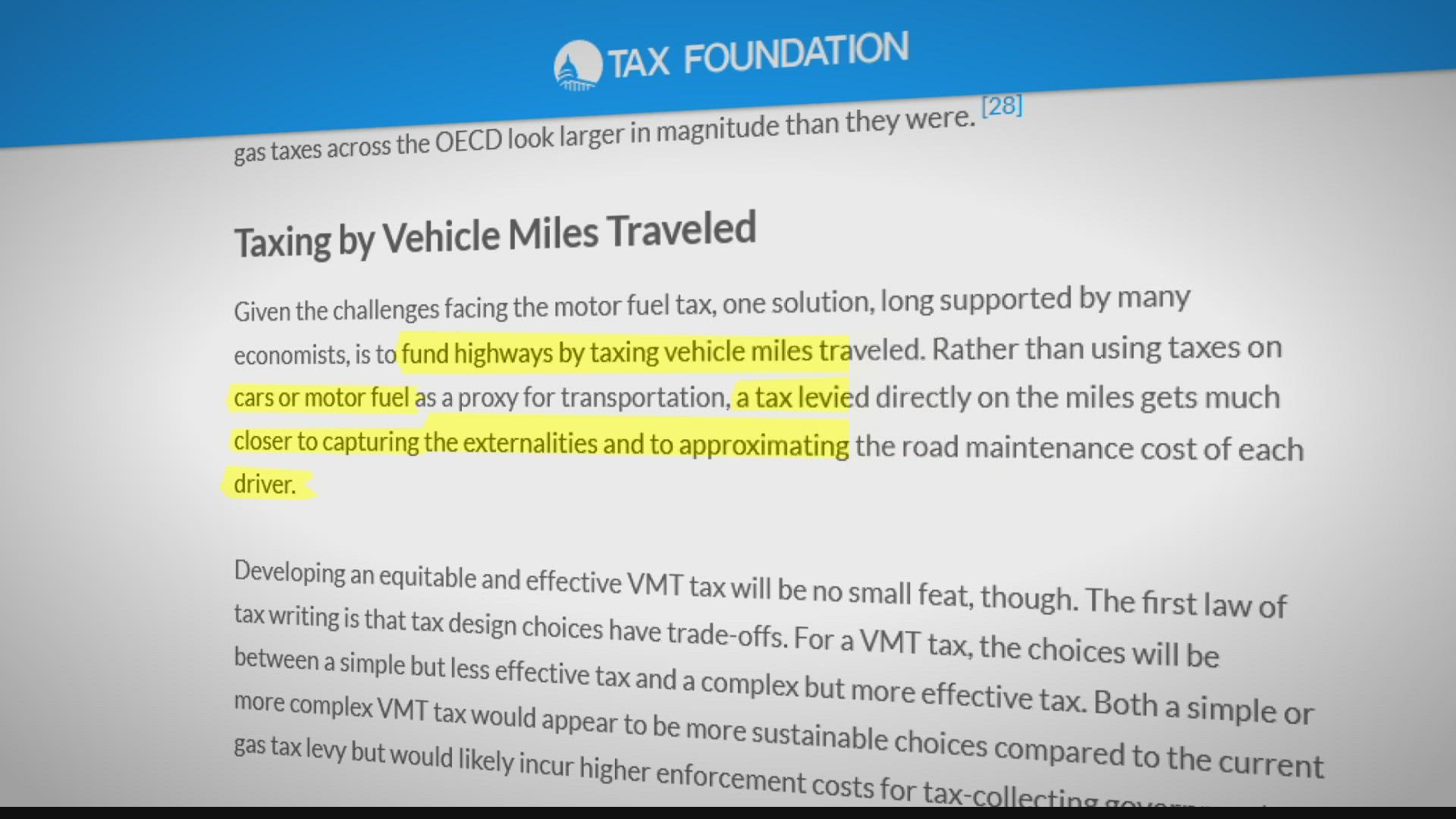

Vehicle Miles Traveled Vmt Tax Highway Funding Tax Foundation

California Expands Road Mileage Tax Pilot Program The Pew Charitable Trusts

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Everything You Need To Know About Vehicle Mileage Tax Metromile

Opinion Mileage Tax Plan San Diegans Debate Per Mile Charges For Drivers The San Diego Union Tribune

Verify Does Infrastructure Bill Include Per Mile User Fee Wthr Com

By The Mile Tax On Driving Gains Steam As Way To Fund U S Roads Bloomberg

A Mileage Tax No Biden S Bill Doesn T Impose New Driving Tax Snopes Com

Pay Per Mile Tax Gets Test Drive In Washington Legislature To Augment Gas Tax Northwest News Network

California Mileage Tax Bill Awaits Governor S Signature Commercial Carrier Journal

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax Nbc 6 South Florida

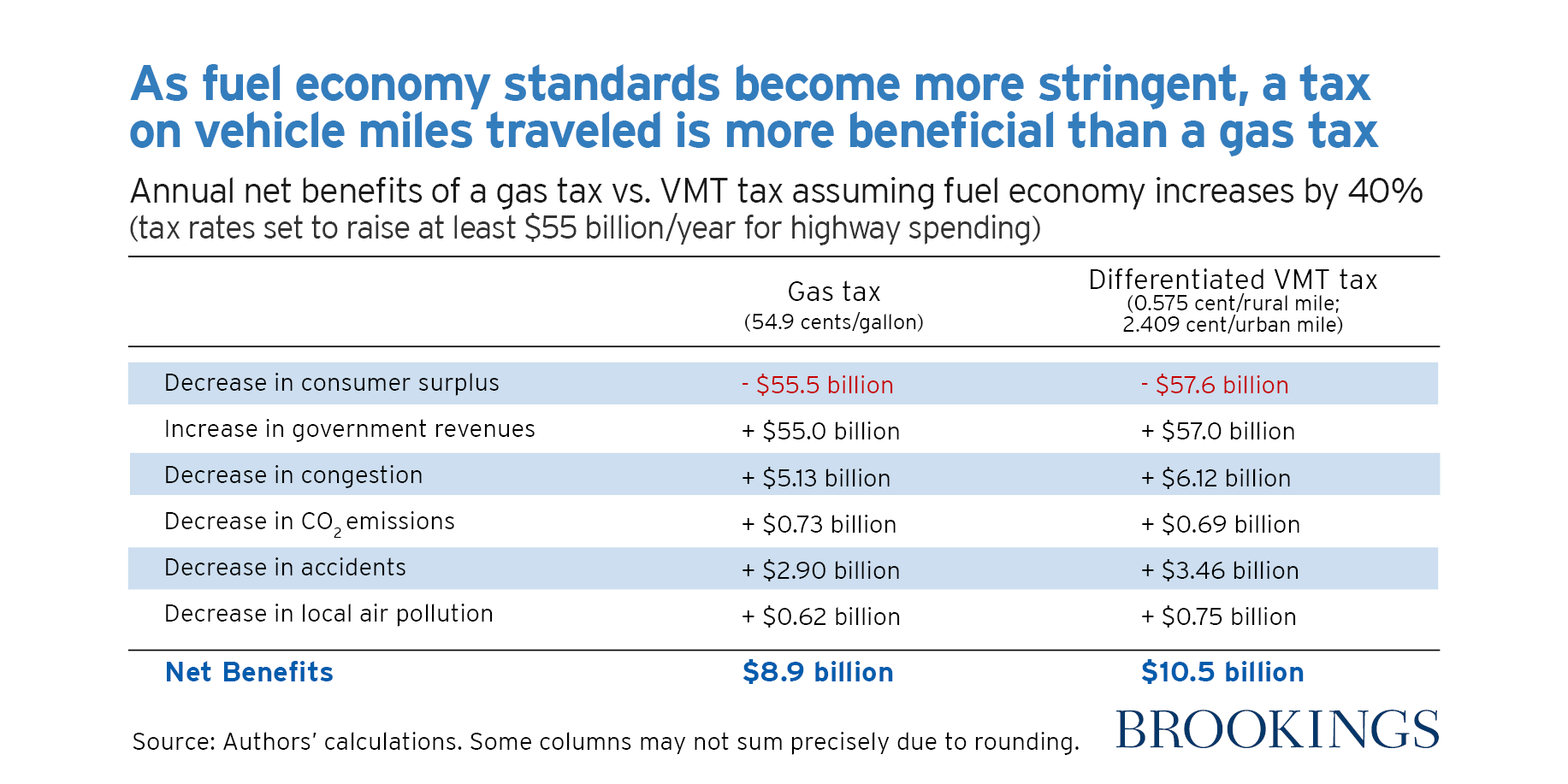

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

What Are The Mileage Deduction Rules H R Block

California Tests Mileage Fee Plan As Answer To Dwindling Gas Tax

Town Hall Organized To Fight Against Sandag S Mileage Tax Hikes Cbs8 Com